Bio-Techne’s Quarterly Earnings Preview: What You Need to Know

/Bio-Techne%20Corp%20sign-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Valued at a market cap of $8.1 billion, Bio-Techne Corporation (TECH) is a leading Minneapolis-based life sciences company that develops and supplies over 500,000 high-quality products, including reagents, diagnostic tools, and analytical instruments for research, bioprocessing, and clinical diagnostics.

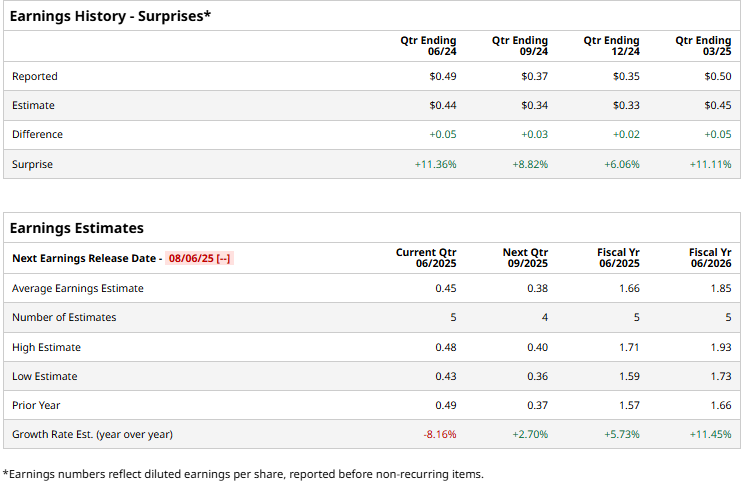

It is expected to announce its fiscal Q4 earnings on Wednesday, Aug. 6. Prior to this event, analysts project this biotechnology company to report a profit of $0.45 per share, down 8.2% from $0.49 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters.

For the current year, analysts expect TECH to report EPS of $1.66, up 5.7% from $1.57 in fiscal 2024.

Shares of TECH have declined 31.9% over the past 52 weeks, considerably trailing both the S&P 500 Index's ($SPX) 12.7% upstick, and the Health Care Select Sector SPDR Fund’s (XLV) 11.8% loss over the same time frame.

On May 7, TECH shares surged over 2% after reporting its Q3 results. The company reported robust earnings driven by solid demand across its core segments, particularly in cell and gene therapy tools, diagnostics, and proteomic solutions. Its revenue came in at $316.2 million, reflecting year-over-year growth, while adjusted earnings per share stood at $0.56, beating analyst estimates.

Wall Street analysts are moderately optimistic about TECH’s stock, with a "Moderate Buy" rating overall. Among 15 analysts covering the stock, ten recommend "Strong Buy," and five indicate “Hold.”

The mean price target for TECH is $64.92, which indicates a notable 21.8% potential upside from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.