The FDA Just Approved Juul’s E-Cigarettes. Does That Make Altria Stock a Buy Here?

Following a prolonged and high-stakes legal battle, the U.S. Food and Drug Administration (FDA) granted Juul marketing approval for its e-cigarettes.

For Altria (MO), a tobacco giant and an early investor in Juul, this is an interesting development. While this is a positive on the regulatory front for the wider e-cigarette industry in general and the company’s own NJOY brand, it also raises competitive pressure for Altria in the vaping market as it no longer holds a position in Juul. Investors should note that at the end of March, Altria also announced that it would halt sales of its NJOY e-cigarettes in the U.S. due to a patent infringement ruling in favor of Juul.

About Altria

Altria is one of the most popular tobacco companies in the world with iconic brand such as Marlboro, Copenhagen, Skoal, and Black & Mild in its portfolio. Its diversified presence also includes smokeless products, cigars, and nicotine alternatives such as the aforementioned NJOY.

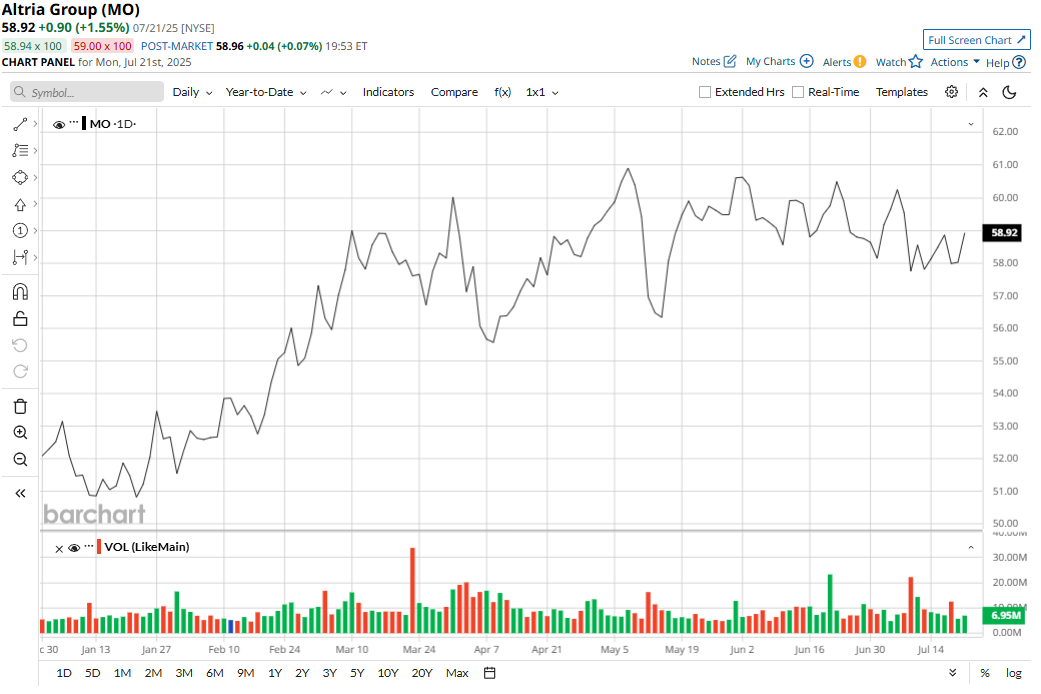

MO stock is up 13.4% on a YTD basis, with the company boasting a market cap of $99 billion. Tobacco stocks are known for having high dividend yields, but Altria’s is especially high at 6.9%. Moreover, the company is a “Dividend King,” having increased dividends consecutively over the past 54 years.

So, how should one play MO stock now? Let’s have a closer look.

Boring But Steady Financials

When it comes to Altria’s numbers, they are nothing extraordinary. In fact, they are quite boring, marked by not much growth.

Over the past 10 years, the company’s revenue and earnings have reported CAGRs of just -0.4% and 8%, respectively.

Following this trend, the first quarter was a mixed bag for the company. While net revenues of $5.5 billion denoted a yearly decline of 5.7%, adjusted earnings went up by 6% in the same period to $1.23. A decline of 13.3% seen in shipments of its flagship Marlboro cigarettes was a primary reason for the overall decline in sales.

Meanwhile, while volumes for NJOY consumables increased by 23.9% from the previous year to 13.5 million units, NJOY devices witnessed a significant 70% decline in reported shipments. Overall, its retail share of consumables increased to 6.6%.

Altria closed the quarter with a cash balance of $4.73 billion. This was above its short-term debt levels of $2.6 billion.

For 2025, the company expects its earnings to be in the range of $5.30 to $5.45 per share, the midpoint of which would represent growth of 5% from 2024.

Altria’s Tailwinds and Headwinds

One growth product for Altria is its On! nicotine pouch brand, which has been gaining ground, and could take the lead in place of NJOY in its alternative portfolio.

The company grew the market share of its On! pouches to 8.8%, up from 7% in the year-ago period. Sales volumes also grew to 39.3 million cans, a jump of 18% from a year ago. Notably, the company sees potential for further expansion, especially with new flavors planned and the possibility of launching On! PLUS in the U.S., a variant currently sold in select European markets.

Further, despite shifting industry trends, Altria’s cigarette business remains strong. Marlboro still holds nearly 46% of the U.S. cigarette market, maintaining its dominance. Additionally, the Black & Mild brand also continues to perform well in the machine-made cigar category. Meanwhile, on the heated tobacco front, often referred to as HTC, Altria is exploring two new products: Ploom and SWIC. Both are marketed as reduced-risk alternatives.

Ploom, a product developed with Japan Tobacco, is awaiting FDA authorization before a potential U.S. debut. While timelines aren’t certain, Altria seems optimistic. The other option, SWIC, features a capsule-style heated tobacco system and might appeal to smokers who haven’t transitioned to vape products but are still looking for non-combustible alternatives.

That said, not all bets have worked out. The $12.8 billion investment in Juul Labs failed to pan out, and Altria eventually abandoned that stake. Perhaps even more problematic was losing the right to sell IQOS in the U.S., a product many had viewed as a cornerstone of its reduced-risk portfolio.

Though On! is gaining, the broader picture in oral tobacco tells a different story. Altria’s overall share in the segment slipped from 37.8% to 34.7% year-over-year. Meanwhile, the NJOY ACE platform is in limbo. The U.S. International Trade Commission issued cease-and-desist and exclusion orders, preventing Altria from importing or selling it domestically for now.

This followed a ruling that NJOY ACE had infringed on four Juul Labs patents. Altria could try modifying the device to bypass those patents, but that approach may be risky. Any major redesign would likely trigger a fresh FDA application, and the approval process is neither quick nor guaranteed.

Analyst Opinions on MO Stock

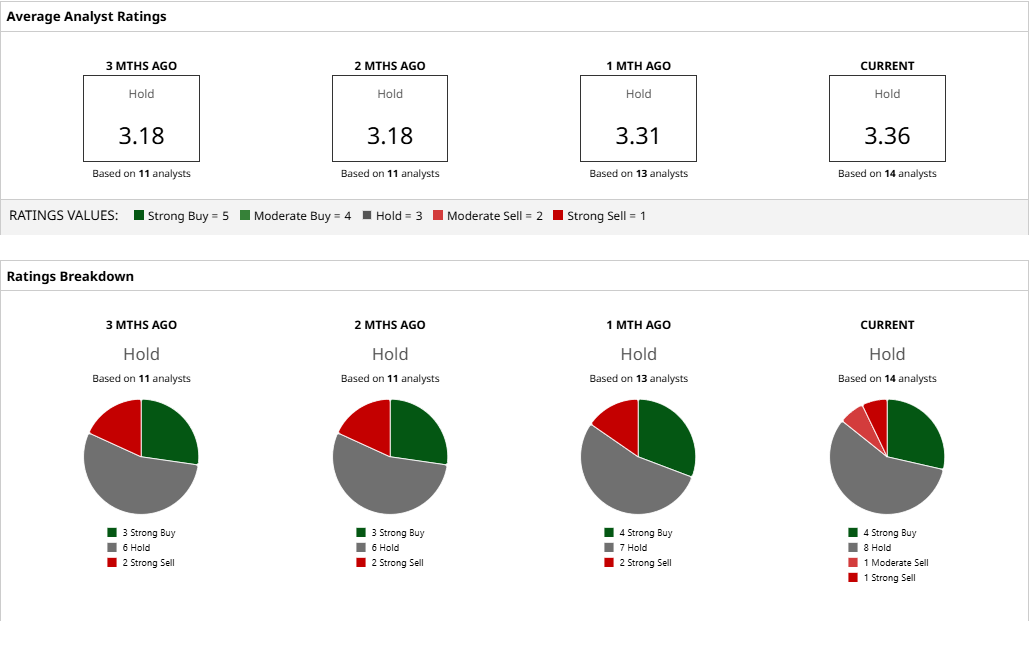

Thus, analysts have deemed MO stock to be a “Hold” with a mean target price of $57.73, which has already been surpassed. However, the high target price of $65 denotes an upside potential of about 8% from current levels. Out of 14 analysts covering the stock, four have a “Strong Buy” rating, eight have a “Hold” rating, one has a “Moderate Sell” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.