This High-Yield Dividend Stock Just Slashed Its Payout. Is It Time to Sell Now?

The global chemical industry is experiencing one of its longest slumps in decades. Oversupply, fierce competition, and sluggish demand are dampening profits across every major region, with production growth expected to reach only about 3% for the year. Cost pressures are also rising due to tariffs and expensive raw materials.

In the middle of these tough conditions, July 24 marked a rough day for Dow (DOW), as the stock dropped 17.45%, its worst single-day slide in five years. This sharp drop followed the company’s decision to halve its quarterly dividend, reducing it from $0.70 to $0.35 per share.

This big move came alongside a tough second-quarter loss of $0.42 per share, which was more than three times worse than what Wall Street had been expecting. Dow’s shares are now trading near a 52-week low of $24.32, reflecting the pressure facing chemical makers across the world.

Dow has long been seen as a reliable choice for steady dividends, but this latest move brings up an important question: Is this a needed reset for a struggling company that’s now facing weaker earnings for longer, or does it point to bigger trouble ahead? Let’s take a look.

What Dow’s Financials Reveal After the Cut

Dow (DOW) is a leader in materials science, transforming raw materials into essential products used in packaging, infrastructure, and consumer goods. Over the past year, DOW’s stock price has dropped 54.3% with a 39% loss just since the start of the year.

Valuations have shot up as profits have slipped, with Dow’s forward price-earnings ratio now at 108.9x, much higher than the industry’s 16.31x average.

Dow’s most recent financial results lay out what’s behind the sweeping dividend cut. Net sales fell 7% year-over-year to $10.1 billion and volume was down across most regions, while local prices also dropped in every segment. Softer revenue, squeezed margins, and heavy restructuring costs all added up to a GAAP net loss of $801 million and an operating EPS loss of $0.42. The cash flow story was just as tough, with operating cash flow from continuing operations turning negative and dropping $1.3 billion from last year.

Where Does DOW Find Its Future Strength?

Two examples of how Dow is trying to stay relevant are its goals of making plastic products more eco-friendly and its teaming up with others on recycling. One example is its work with Liby to use more recycled plastic in everyday goods, matching what buyers and brands want in packaging that’s better for the environment. Dow has also rolled out the INNATE TF 220 Resin, which helps create strong, recyclable plastic films.

Backing all this up is Dow’s recent second agreement with PT Eterna Persada in Indonesia, aiming to boost the supply of quality recycled plastics and support recycling efforts in Asia. These steps support Dow’s reputation for sustainability and could open new business in growing markets.

Still, these plans are running into tough financial times. After years of paying a bigger dividend, Dow’s board decided to cut the quarterly payout from $0.70 to $0.35 a share. That brought the annual yield down to 5.7%. Management made this move to save cash and keep the company flexible for whatever comes next, as shown by the $496 million in dividends paid in the second quarter.

DOW’s Road Ahead After the Fallout

The outlook remains tough. Analysts expect the company to lose $0.21 per share for the current quarter, which is a sharp drop, down nearly 145% from the $0.47 earned a year ago. For all of 2025, estimates point to a loss of $0.51 per share, a steep fall from last year’s $1.71 earnings.

Even so, there are a few optimists on Wall Street. Frank J. Mitsch at Fermium Research recently moved Dow to a “Buy” rating with a $35 price target after the first quarter of 2025. Mitsch thinks decisions to postpone certain key projects, along with planned asset sales and expected lawsuit payouts, should make it easier for Dow to keep paying its dividend through 2026.

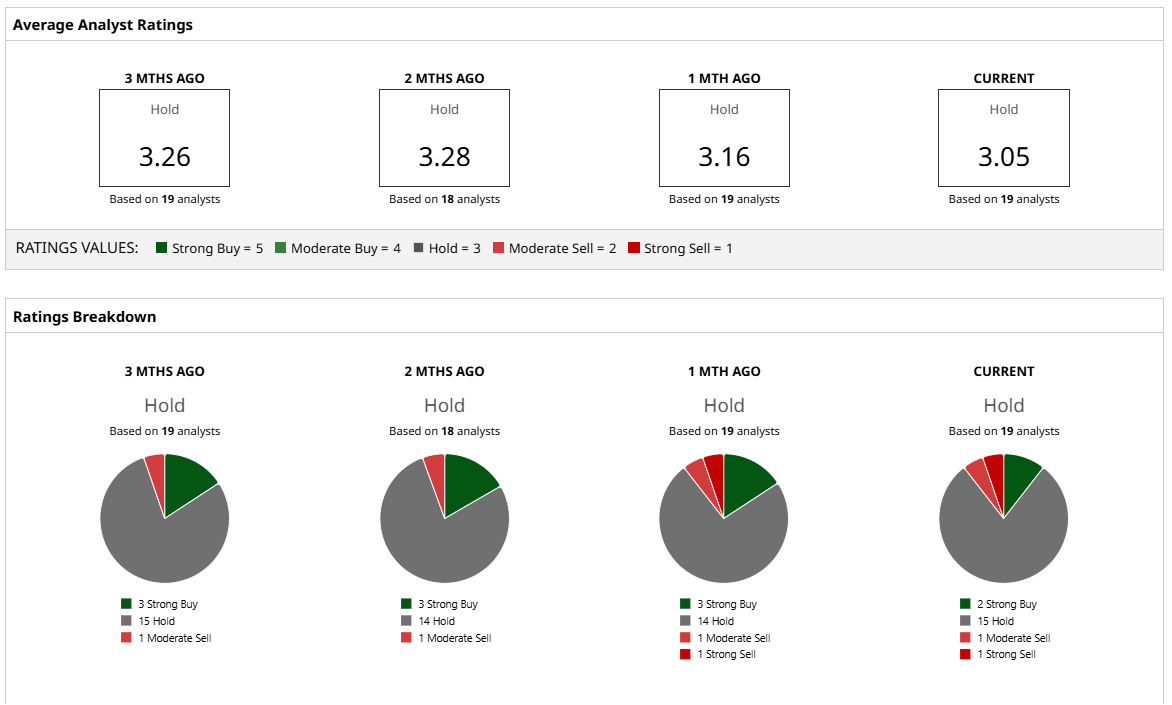

Most analysts, though, are staying cautious. Out of 19 surveyed, the general view is still “Hold.” The average price target is $28.50, which means there’s about 17% potential upside from it’s current price.

Conclusion

Dow’s dividend cut is a setback for income investors, but it’s not a definitive warning sign. The company faces pressure from declining profits and a tough market, yet it is implementing cost controls and sustainability efforts. With analysts predicting some upside and a focus on balance-sheet strength, this is not a time for panic-selling. It’s a situation to hold and see if Dow’s strategy yields results.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.