Up 130% in the Past Year, Are the Good Times Finally Over for Carvana Stock?

/Electric%20vehicles%20by%20Wulandari%20Wulandari%20via%20Shutterstock.jpg)

Used car retailers have staged a remarkable comeback over the past year, as easing interest rates and improving consumer demand have helped drive valuations higher. Carvana (CVNA), in particular, has been one of Wall Street’s biggest surprises, with its stock doubled in the past 12 months as investors cheered the company’s cost-cutting measures and improved profitability outlook.

But the rally may be facing a new test. Hertz (HTZ) just announced that it will sell certified pre-owned vehicles through Amazon’s (AMZN) online auto marketplace, a move that could intensify competition in the digital used-car space. The development raises questions about whether Carvana can maintain its growth trajectory as rivals expand their reach.

With shares pulling back on the news, investors are left wondering if the good times for Carvana stock are finally over. Let's find out.

About CVNA Stock

Based in Tempe, Arizona, Carvana is a leading e-commerce platform for buying and selling used cars in the United States. The company built its brand around convenience, allowing customers to browse, finance, and purchase vehicles entirely online, with delivery or pickup available through its well-known car vending machines. This disruptive model fueled rapid growth and positioned Carvana among the country’s fastest-growing online retailers.

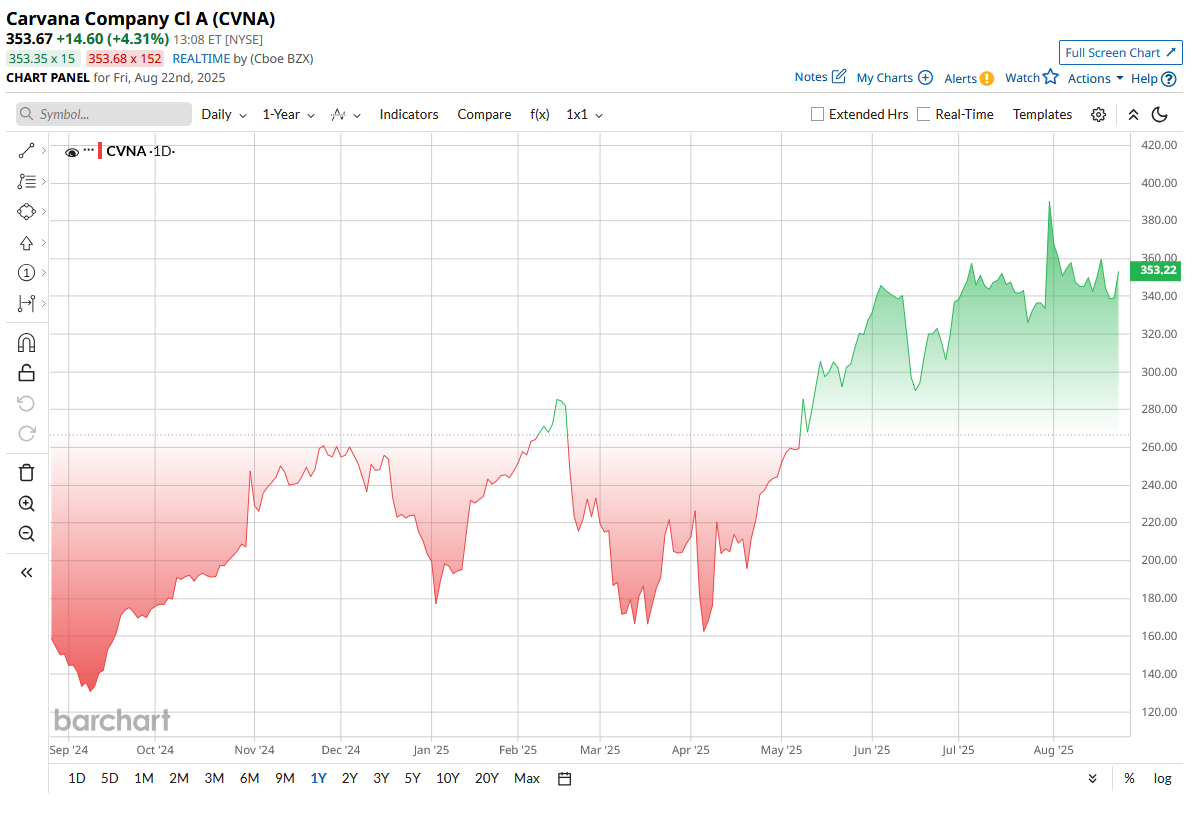

CVNA stock has staged a sharp rebound over the past year, climbing about 130%. The rally has been supported by aggressive cost-cutting efforts, successful debt restructuring, and a recovery in demand for more affordable used vehicles.

However, questions around valuation remain. Carvana’s price-to-book (P/B) ratio currently sits nearly 35x, far above the sector median of 2x. This gap suggests the stock may be trading at a significant premium relative to peers.

Amazon Threat Looms

Carvana’s stock dropped sharply after Hertz said it would sell certified pre-owned cars through Amazon Autos, starting in four cities and later nationwide, which shows growing pressure on online used-car dealers as competition intensifies.

Amazon’s scale, smooth checkout, and Hertz’s large fleet could draw shoppers away from online dealers by offering inspections, warranties, and financing. That raises competition and may pressure Carvana’s margins.

Still, Carvana’s edge lies in its full platform, sourcing, reconditioning, financing, and delivery, which Amazon can’t easily copy. Overlap with Hertz’s fleet may also be limited for now. The impact depends on Amazon’s execution, leaving investors split on whether the selloff was overdone.

CVNA Beats Q2 Earnings Estimate

Carvana delivered a strong Q2 earnings report that topped the analyst estimate. The company reported record revenue of $4.84 billion, up 42% year-over-year (YOY), powered by all-time quarterly retail volumes of 143,280 units.

Carvana posted net income of $308 million in the quarter versus $48 million a year earlier, a swing of roughly $260 million.

Free-cash-flow dynamics also improved. In the quarter, Carvana generated roughly $200–$205 million of free cash flow and had about $1.93 billion in cash, cash equivalents, and restricted cash.

Management framed the quarter as validation of its vertically integrated model. CEO Ernie Garcia said, “Our record Q2 results further validate the strength and differentiation of the Carvana model, driving profitable growth and even better customer experiences,” language that reinforced the company’s thesis of scale leading to durable margin improvement.

Looking near-term, Carvana expects a sequential increase in retail units sold in Q3, provided market conditions remain stable, and reiterated the raised adjusted-EBITDA target for full-year 2025.

Wall Street projects 2025 revenue of $18.8 billion and EPS of $5.07, but execution risks, margin pressure, credit weakness, and unit trends remain key watchpoints for investors.

What do Analysts Say About CVNA Stock

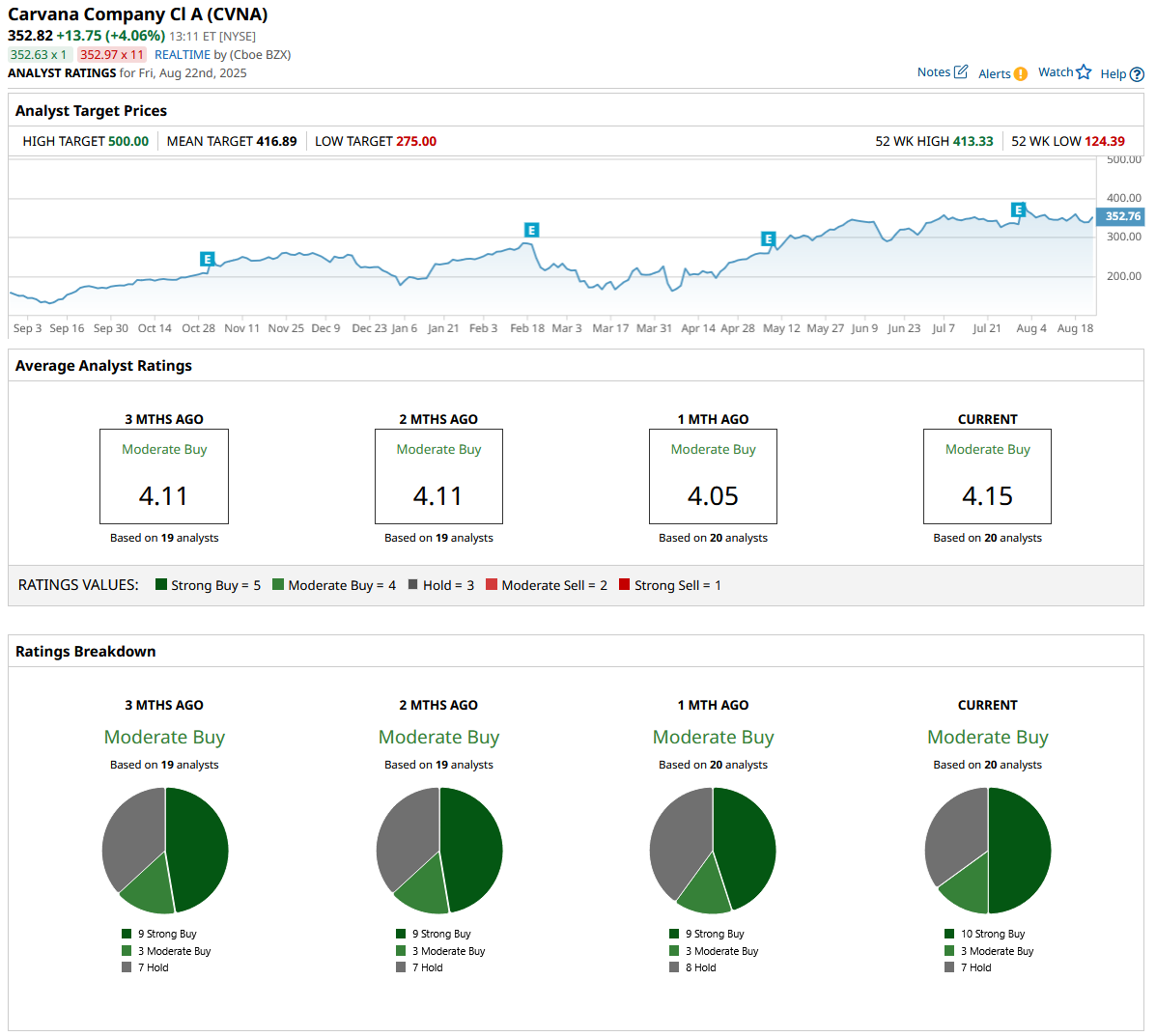

Following the earnings release, Bank of America’s Michael McGovern maintained his bullish stance on Carvana, reiterating a “Buy” rating. He set a price target of $425, suggesting the shares could climb roughly 15% above current trading levels.

In his note, McGovern highlighted that Carvana is gaining momentum from a shift in consumer demand toward used vehicles, as budget-conscious buyers increasingly look for affordability in a higher-rate environment.

Overall, Wall Street analysts hold a consensus “Moderate Buy” rating on the stock, with an average price target of $417, implying about 20% upside potential from current levels.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.