What is the Most Likely Outcome of this Week's Fed Meeting?

First and foremost, the US president continues to demand a cut to the US Fed fund rate.

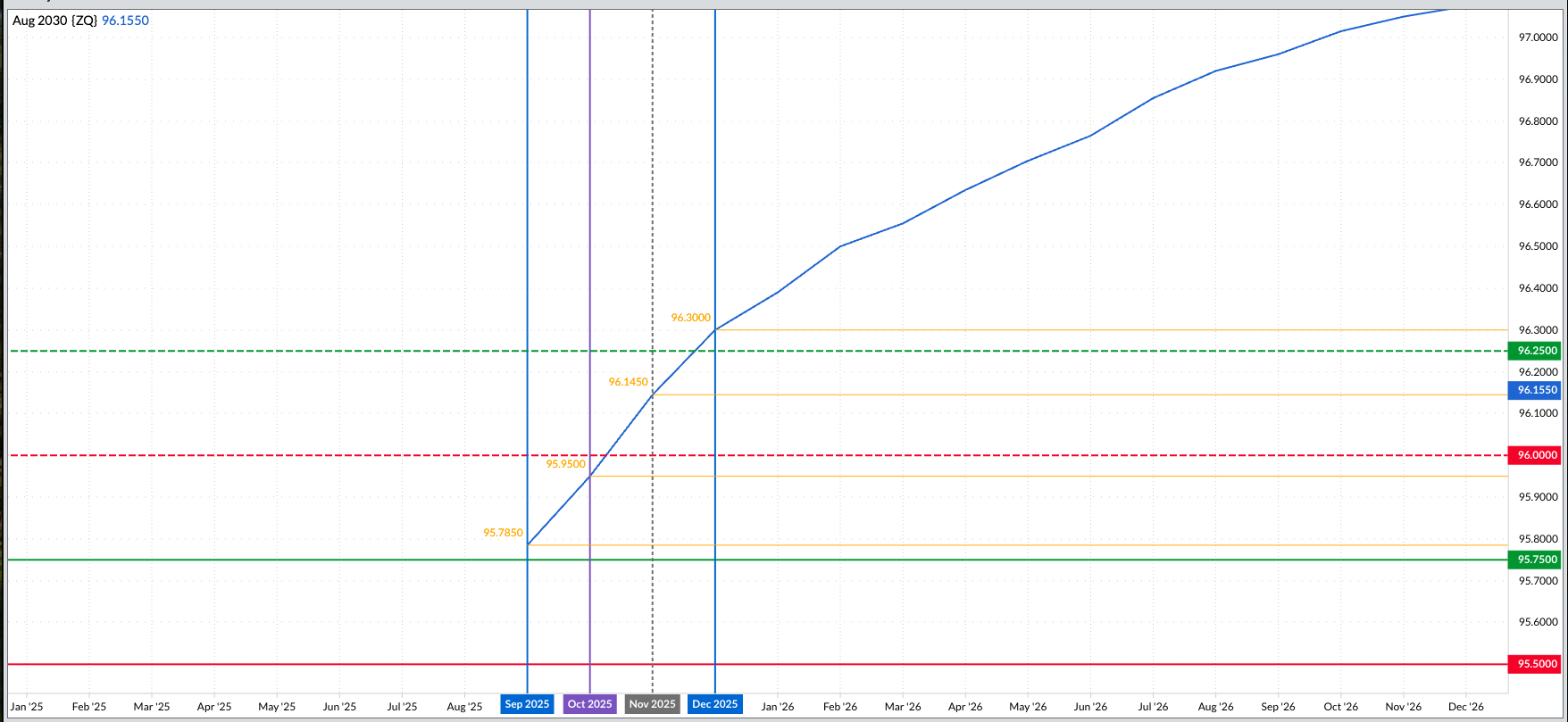

This time around, the Fed fund forward curve is indicating a rate cut is likely.

However, it isn't likely to be the 50-basis point cut the president and his followers are calling for. At least not yet.

The week that so many have had circled on their calendar has finally arrived. Yes, the US Federal Open Market Committee (FOMC, the Fed) holds its next 2-day meeting this week, starting Tuesday and concluding Wednesday afternoon with Fed Chairman Jerome Powell making an announcement on interest rates. It’s interesting to listen to the rhetoric – I’m sorry, I mean debate – regarding what Chairman Powell should announce. The interesting thing about this ongoing “debate” is that most of it has nothing to do with economics but falls along political lines instead. Stop and think about it for a moment: Most of the opinions, loudly expressed, would fall on the other side of the debate if a member of the opposing party occupied the big chair in the US White House.

What I find humorous is that the sitting US president is adamant about the Fed lowering interest rates, despite such a move signaling the economy is suffering due to his one-word trade policy. If we take a step back and think about it for a moment, what tends to happen when interest rates are lowered is that the country’s currency tends to weaken. And when a currency weakens, the price of goods and services tends to go up. This after the US continues to deal with the self-imposed consumer tax also known as “tariffs”. How many of you recall what happened between 2018 and 2020 when the ongoing trade wars and tariffs were new and the same individual demanded interest rates stay low, or maybe even being taken into negative territory[i]. The US is still dealing with the fire of inflation that was fanned back then. Why does the US president want low to negative interest rates? Because he equates the economy with US stock indexes, and the latter tends to trend up as interest rates move down.

Looking ahead to this week’s FOMC meeting, the market is clear on what it believes the Fed will do. There are four possibilities:

- A 50-basis point rate cut.

- A 25-basis point rate cut.

- The Fed fund rate is left unchanged once again.

- A 25-basis point rate hike.

Let’s talk about the likelihood of each of these possibilities.

A 50-basis point rate cut: Talk of this has grown louder from the president’s most ardent supporters over the past couple weeks. But then again, this group can’t be taken too seriously because, well, you know. Based on what we see in the Fed fund futures forward curve, a 50-basis point rate cut doesn’t seem likely this week. At last Friday’s close, the September 30-day fed funds futures contract (ZQU25) was priced at 95.785, implying a rate of 4.215%, below the low end of the current range at 4.25%. Meanwhile, the October contract (ZQV25) closed at 95.95 putting the implied rate at 4.05% with the next FOMC meeting scheduled for October 28 and 29. However, the November contract (ZQX25) closed at 96.145 (3.855%) with December (ZQZ25) at 96.3 (3.7%) and the last meeting of 2025 scheduled for December 9 and 10.

A 25-basis point rate cut: Based on what we see in the Fed fund futures forward curve, this is the most likely scenario. Again, the September futures contract puts the implied rate below the low end of the current range at 4.25%. If Chairman Powell announces a 25-basis point rate cut, the range drops to between 4.0% and 4.25% with the October contract putting the implied rate slightly above the low end 4.0%. Once we get past the October meeting, though, things could get fun. There is no meeting scheduled for November, and the December futures contract puts the implied rate at 3.7%, below not only the expected low end of 4.0% but another 25-basis point cut to 3.75%. In other words, the market is indicating a possible 50-basis point rate cut at the conclusion of the December meeting.

The Fed fund rate is left unchanged. While this is the most logical conclusion given continued US inflation and questions about the jobs sector, the Fed isn’t likely to take the unchanged route this time. Why? The US president needs to be pacified, and so a 25-basis point cut would be like giving a cookie to a screaming child. The economic logic is easy to see: If the Fed goes through with a 25-basis point cut, it most likely won’t change the situation all that much for the average person. Yes, inflation will likely heat up a bit, but the FOMC would still be in position to raise rates to dampen the fire at the conclusion of either the October or December meetings.

A 25-basis point rate hike. The Kansas City Royals have a better chance of making the Major League Baseball (MLB) playoffs than the Fed announcing a rate cut this week[ii]. In other words, it isn’t going to happen. That being said, this is the outcome I would like to see, for a number of reasons. From an economic point of view, this would be an indication the Fed is actually keeping an eye on real inflation rather than the mixed signals coming from government reports. From a political point of view this would tell us the Fed is trying to stay neutral, taking its role of monetary policy seriously rather than getting caught up in the political nonsense of the day. From a personal point of view, I would thoroughly enjoy watching the US president blow a gasket if Chairman Powell announced a rate hike. However, the Butterfly Effect tells us it could create an unforeseen storm. And that is a risk the Fed won’t likely take.

[i] Keep in mind this is the same US president who wants final say over all interest rate decisions.

[ii] The Royals are 6 games out of the final Wild Card spot with 12 games remaining in the season and three teams ahead of them.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.